Often people are not very well aware of the wealth management. Imagine you have been working hard you entire life and now you have been blessed with incredible wealth. What good is this wealth if you do not know how to use it effectively. Rather than experimenting with your wealth and wasting them on useless ventures, it is better that you rather have your money managed by a wealth manager.

How the wealth manager assesses your financial status?

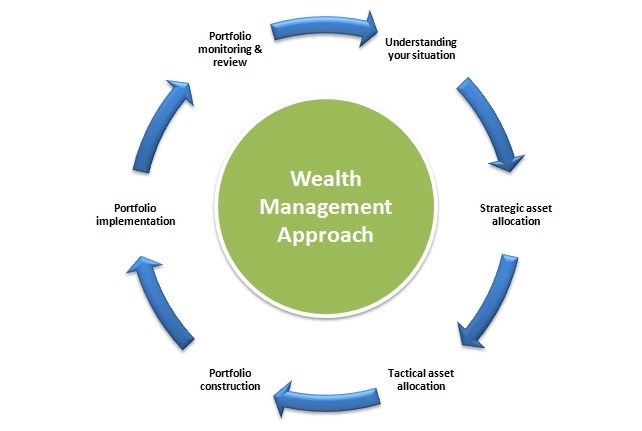

A wealth manager is an individual that manages your financial data with their experience and assessment. He/She can assess the possible portfolios where you can invest your money in. Moreover, they can also plan your tax expenses and the retirement fund accordingly. Portfolio investments are one of the most ideal way for your money to get their perfect destination. A wealth manager sits down with the owner and then talks about the possible objectives that their client is aiming forward to in the upcoming years. Once they have analyzed the possible objectives of the business or the individual, i.e. their short and long term objectives, he will then suggest the possible portfolio investments for the client.

Basic elements of a wealth management portfolio

Wealth management portfolio is the ideal method that one can use in order to gain maximum returns for their investment. Rather than leaving their money spare, it is advisable to invest it in a venture or ventures (preferably) to gain some return out of it. In order to learn more about the wealth management portfolio solutions, feel free to visit our website.

Asset allocation: Like no two fingers are same, no two assets have the same volatility. Some assets have a much more volatile nature than others and hence they have to be treated accordingly. It is up to the investor to see if they want a higher or lower correlation of assets to each other. It is ideally advisable to have a lower correlation of assets amongst each other in order to achieve a good result.

Diversification of risk: The ideal purpose of investing in a management portfolio is to diversify the risk associated to it. Rather than investing all the money into a venture, it is advisable to invest the wealth in a much wiser pool of money in order to diversify the risk. Investing in a single entity increases the risk and makes the investment more volatile in nature. Diversification helps to minimize the risk. If one business fails to provide positive returns, the other might cover up for it.

Rebalancing: Many of the investors are not really aware of this new method. Rebalancing is an attempt to return the portfolio back to where it started as its target annually. This is a very effective technique that helps the business in retaining the perfect asset mix. Through this, the investment will enjoy the ideal risk and return profile that gains the maximum return with minimum risk. If the business doesn’t do rebalancing on regular basis, they might be facing much more risks in the future.

2018 ·

2018 ·